The opposition is very vocal in demanding answers from Modi government as to what is he doing to get back money from loan defaulters and NPA which Rahul Gandhi’s party was very much responsible for creating it.

But here is the answer how Modi government is making the loan defaulters pay back their due without much effort. Two years back, when Narendra Modi government introduced the Insolvency and Bankruptcy Board of India (IBBI) many banks and their managers did not encourage this move. They very well knew that the impact of Bankruptcy act will make companies who were pretending to have no money pay the loan amount they had taken.

Today, because of the act, the banks have become the biggest beneficiaries as the loan defaulters have started to pay the money back. Yes, the government’s action to shut down companies if they pretend to be in loss. So the fear of insolvency action has helped creditors, led by banks, recover Rs 1.1 crore from loan defaulters who had earlier refused to repay and clear huge amount of loans and falsely claimed they were at loss. Now these companies who have been given notices of insolvency have suddenly agreed to pay back money to the banks.

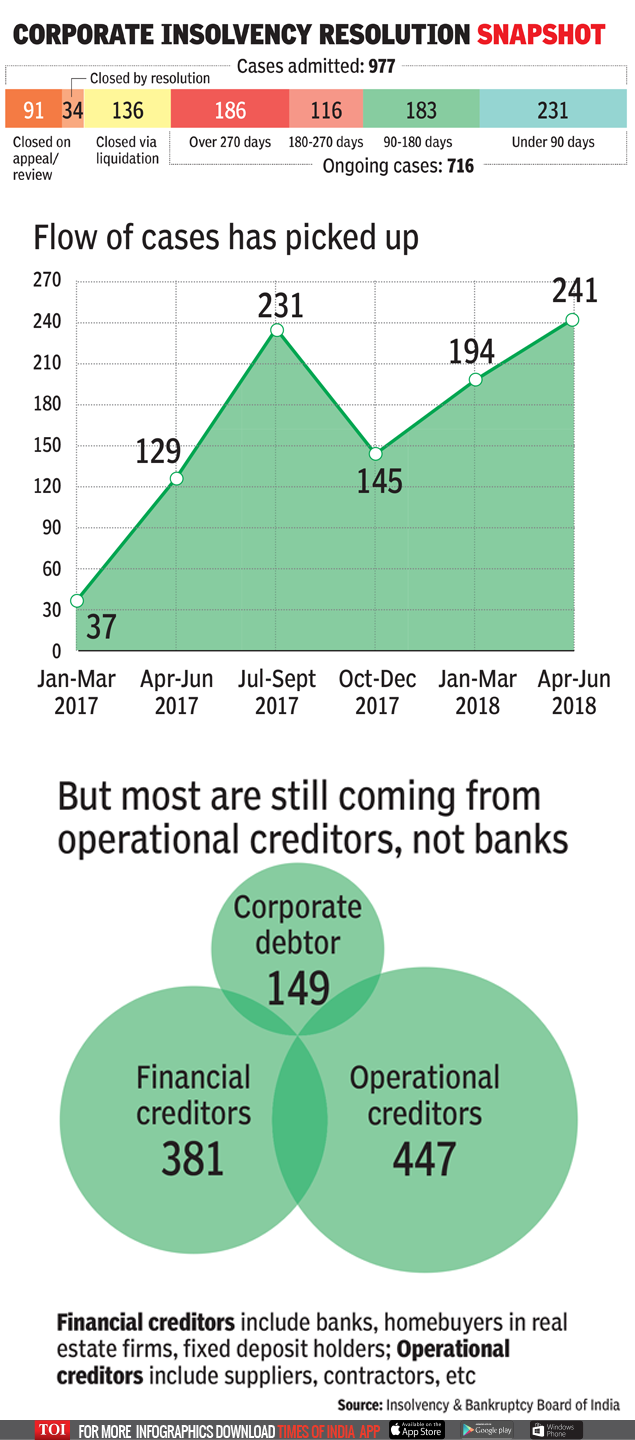

According to reports, so far, 977 cases have been admitted by the National Company Law Tribunal (NCLT) where either the lenders or the operational creditors, such as suppliers, have sought to initiate action. The number of cases filed is almost four times higher, sources said, but many are withdrawn before they are admitted as the borrower agrees to settle the dues. “It would be wrong to say that all the cases are withdrawn because the debtor pays up, but we are seeing that dues are cleared in a large number of cases once a case is filed,” a senior official said. TOI Report

The sources in the finance ministry said that the government was aiming to recover Rs 1.8 Lakh crore in this financial year which is two-and-a-half times the amount recovered in 2017-18. The finance ministry has black listed those companies who have failed to repay loans and barred their promoters from bidding in future until they clear all their loan amount.

The Insolvency act has lead to the recovery of money in 42% cases which had given 180 day period deadline. Another 90 day extension period has been given to ongoing 716 cases said the report. “Probably, India is the only country where the process has to be completed in a time-bound manner. In the coming months, the situation will improve,” IBBI chairman M S Sahoo told TOI. Officials said the government was in the process of appointing more members to the NCLT benches which deal with insolvency cases.

The reports also showed that in the month of June, three of the the 12 cases where resolution took place, lenders managed to realise their entire claims. In the MBL Infrastructure case, the banks have made a recovery Rs 1,600 crore against claims of Rs 1,428 crore.In the Orissa Manganese and Minerals case, the banks have managed to get Rs 310 crore of the total claims of Rs 5,388 crore. This was the case that made government take a stringent action against them barring from contesting from all bidding process.

Source: Postcard

No comments:

Post a Comment